China Automobile Association's January new energy vehicle data

Date: 2019/2/28 10:20:04 Publisher: LUTZ Shanghai

On February 18, according to data released by the China Automobile Association, China's new energy vehicle production and sales in January completed 91,000 and 96,000, respectively, an increase of 113% and 138%, a decrease of 57.6% and 57.5%.

In January, the production and sales of new energy vehicles were 91,000 and 96,000 respectively, an increase of 113% and 138% respectively over the same period of the previous year. Among them, the production and sales of pure electric vehicles were 67,000 and 75,000 respectively, up 141.1% and 179.7% respectively over the same period of last year. The production and sales of plug-in hybrid vehicles were 24,000 and 21,000 respectively, up from the same period of last year. 59.9% and 54.6%.

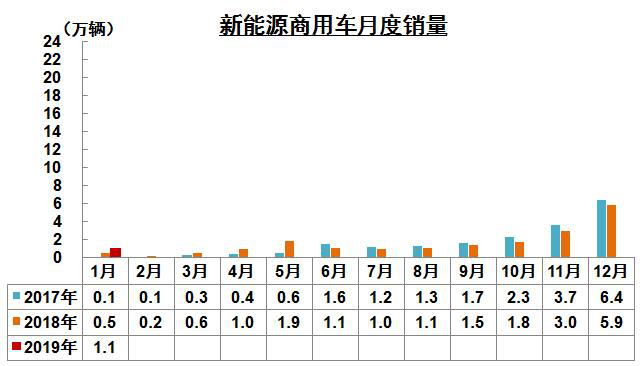

According to the production and sales of new energy vehicles, the production and sales of new energy passenger vehicles were 82,000 and 85,000 respectively, up 115.9% and 138.3% respectively over the same period of last year. The production and sales of new energy commercial vehicles were respectively 9 million and 11,000. , an increase of 90.1% and 135.1% over the same period of the previous year.

The pure electricity market accounted for 78% of the hybrid market and the momentum is stronger in the short term.

From the perspective of different power driving methods, the production and sales of pure electric vehicles in January 2019 were 67,000 and 75,000 respectively, up 141.1% and 179.7% respectively over the same period of last year; the production and sales of plug-in hybrid vehicles were 24,000 respectively. And 21,000 vehicles, an increase of 59.9% and 54.6% over the same period of the previous year.

Obviously, pure electric power is still the main force in the new energy market, accounting for 78% of the market. However, hybrid power has shown strong market growth since 2018. Many industry insiders believe that in the post-subsidy era, hybrid vehicles with more comprehensive performance will be more competitive in the market.

Although the current subsidy policy for PHEV is not clear, it still maintains a more optimistic view of the PHEV market, mainly in the restricted cities, PHEV is a greater beneficiary (performance is better than pure electricity), and short-term The license of the internal PHEV will not change, and it is expected that it will maintain a relatively high growth rate in 2019.